Based on the W-2 provided, Social Security tax withheld for Lily was ______ of wages and Medicare tax - Brainly.com

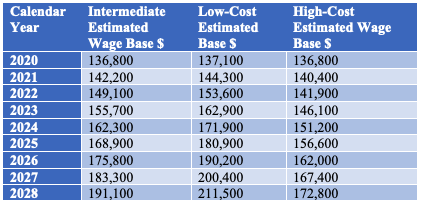

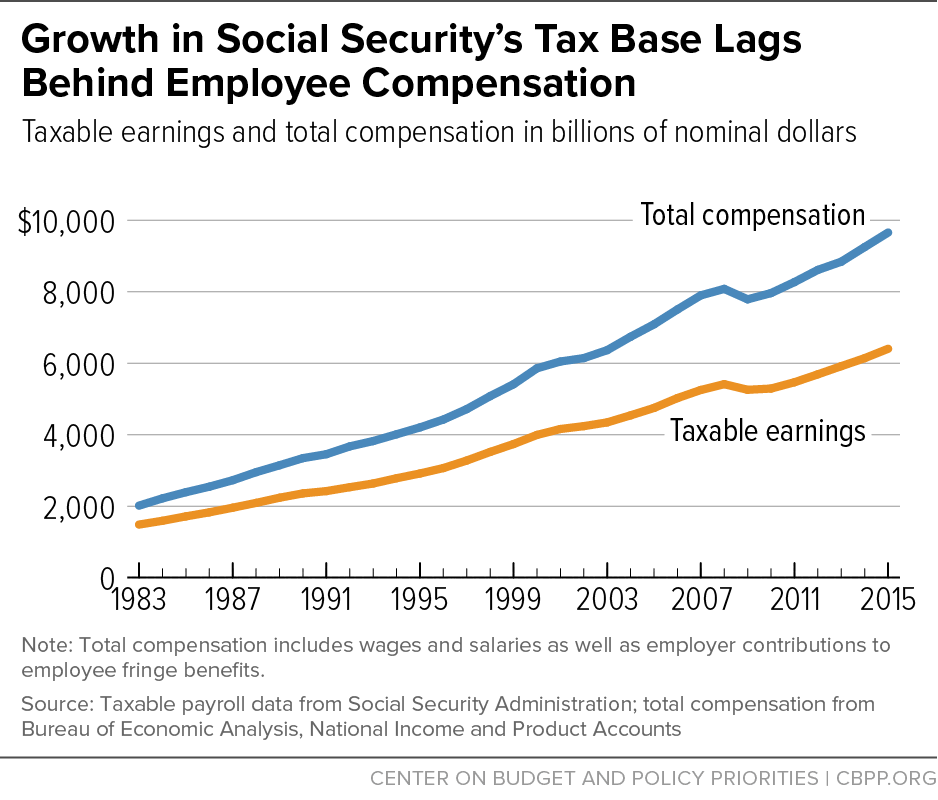

Social Security Payroll Tax: Here's How Much the Average American Will Owe in 2018 | The Motley Fool

Can someone explain why social security wages box 3 is so high on taxes? Is this an error? I only worked last 2 months of 2022. : r/Dominos

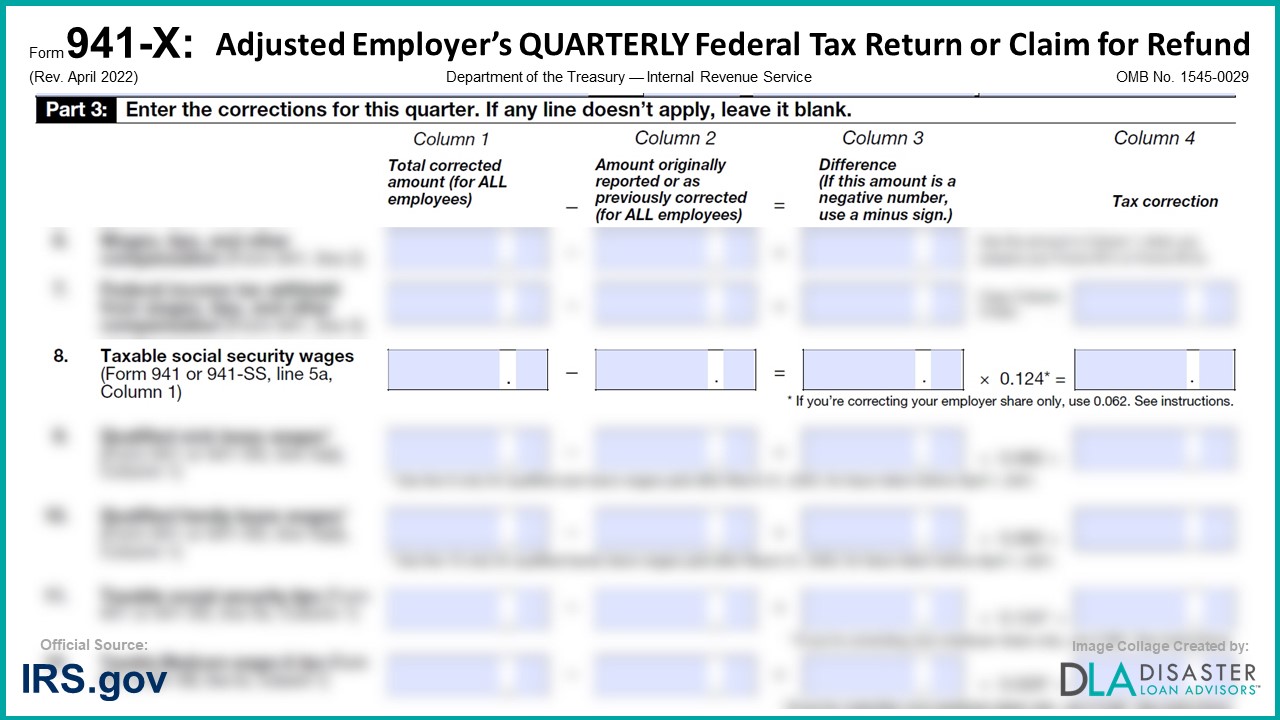

941-X: 19. Special Additions to Wages for Federal Income Tax, Social Security Taxes, Medicare Taxes, and Additional Medicare Tax, Form Instructions | DisasterLoanAdvisors.com

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

.png?width=5000&height=3994&name=MicrosoftTeams-image%20(3).png)